Portugal Vat Number Format . If the turnover exceeds €10,000 it is. 31 rows the relevant nation’s country code — consisting of two letters — is inserted before the vat number if the company is using the. Vat is paid by consumers when paying for goods or services. The vat laws in portugal are based on eu legislation, of which portugal was a founding member. For a business registered entity on an individual or company format, to carry out business transactions in portugal, it is required to register for vat. Value added tax (vat) is a tax levied on sales or supplies of services in portugal. Upon completion of the registration process, the taxpayer is assigned a tax identification number in the format of. 28 rows use these eu country codes, vat numbers and foreign language letters to complete an ec sales list (esl).

from taxfoundation.org

Value added tax (vat) is a tax levied on sales or supplies of services in portugal. 28 rows use these eu country codes, vat numbers and foreign language letters to complete an ec sales list (esl). If the turnover exceeds €10,000 it is. Vat is paid by consumers when paying for goods or services. Upon completion of the registration process, the taxpayer is assigned a tax identification number in the format of. For a business registered entity on an individual or company format, to carry out business transactions in portugal, it is required to register for vat. The vat laws in portugal are based on eu legislation, of which portugal was a founding member. 31 rows the relevant nation’s country code — consisting of two letters — is inserted before the vat number if the company is using the.

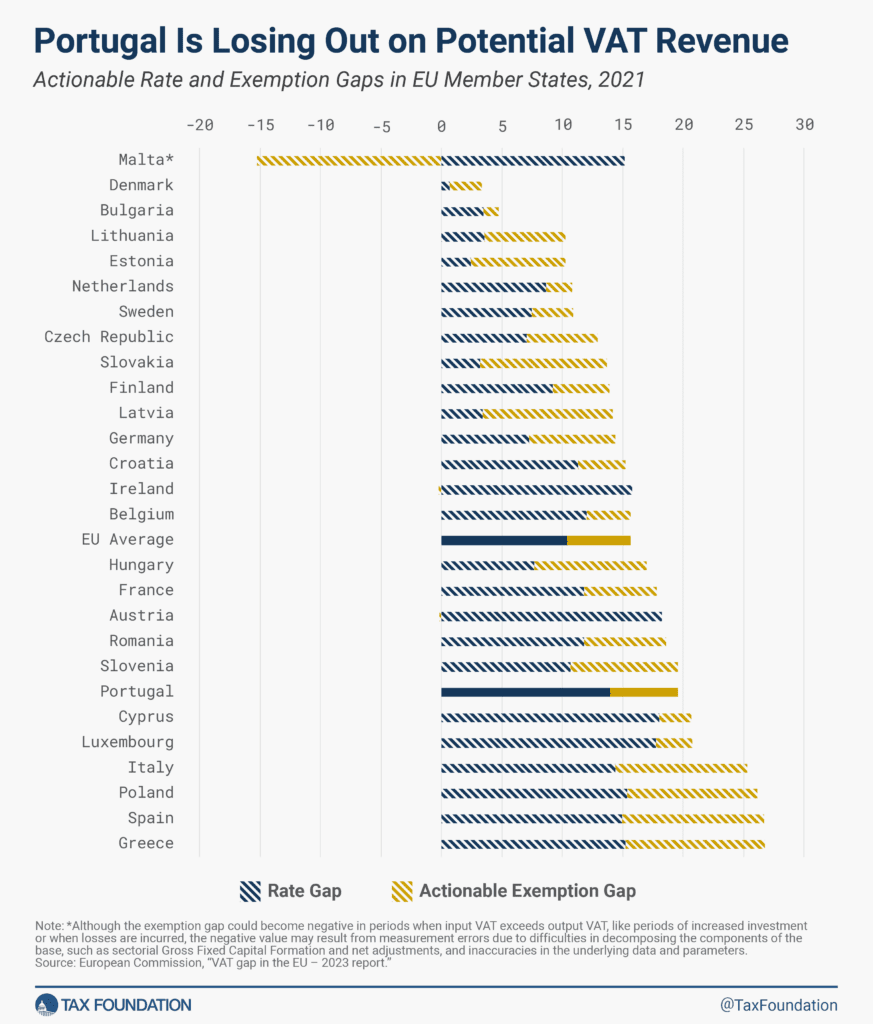

Portugal VAT Reform Options Tax Foundation

Portugal Vat Number Format 31 rows the relevant nation’s country code — consisting of two letters — is inserted before the vat number if the company is using the. If the turnover exceeds €10,000 it is. Value added tax (vat) is a tax levied on sales or supplies of services in portugal. Upon completion of the registration process, the taxpayer is assigned a tax identification number in the format of. The vat laws in portugal are based on eu legislation, of which portugal was a founding member. 28 rows use these eu country codes, vat numbers and foreign language letters to complete an ec sales list (esl). 31 rows the relevant nation’s country code — consisting of two letters — is inserted before the vat number if the company is using the. Vat is paid by consumers when paying for goods or services. For a business registered entity on an individual or company format, to carry out business transactions in portugal, it is required to register for vat.

From create.onlineinvoices.com

Free Invoice Templates Online Invoices Portugal Vat Number Format 28 rows use these eu country codes, vat numbers and foreign language letters to complete an ec sales list (esl). Upon completion of the registration process, the taxpayer is assigned a tax identification number in the format of. 31 rows the relevant nation’s country code — consisting of two letters — is inserted before the vat number if the company. Portugal Vat Number Format.

From www.lawyers-portugal.com

VAT in Portugal Portugal Vat Number Format Value added tax (vat) is a tax levied on sales or supplies of services in portugal. 28 rows use these eu country codes, vat numbers and foreign language letters to complete an ec sales list (esl). Vat is paid by consumers when paying for goods or services. For a business registered entity on an individual or company format, to carry. Portugal Vat Number Format.

From www.fonoa.com

Portugal Introduces VAT Changes and Postpones the SAFT Accounting Files Portugal Vat Number Format Value added tax (vat) is a tax levied on sales or supplies of services in portugal. If the turnover exceeds €10,000 it is. For a business registered entity on an individual or company format, to carry out business transactions in portugal, it is required to register for vat. The vat laws in portugal are based on eu legislation, of which. Portugal Vat Number Format.

From www.pdffiller.com

Fillable Online Value Added Tax (VAT) in Portugal Fax Email Print Portugal Vat Number Format Upon completion of the registration process, the taxpayer is assigned a tax identification number in the format of. If the turnover exceeds €10,000 it is. For a business registered entity on an individual or company format, to carry out business transactions in portugal, it is required to register for vat. The vat laws in portugal are based on eu legislation,. Portugal Vat Number Format.

From www.youtube.com

How to Register for VAT in Portugal YouTube Portugal Vat Number Format Upon completion of the registration process, the taxpayer is assigned a tax identification number in the format of. Value added tax (vat) is a tax levied on sales or supplies of services in portugal. For a business registered entity on an individual or company format, to carry out business transactions in portugal, it is required to register for vat. Vat. Portugal Vat Number Format.

From vatstack.com

How to Check and Validate EU VAT Numbers Vatstack Portugal Vat Number Format 31 rows the relevant nation’s country code — consisting of two letters — is inserted before the vat number if the company is using the. 28 rows use these eu country codes, vat numbers and foreign language letters to complete an ec sales list (esl). Value added tax (vat) is a tax levied on sales or supplies of services in. Portugal Vat Number Format.

From taxfoundation.org

Portugal VAT Reform Options Tax Foundation Portugal Vat Number Format Vat is paid by consumers when paying for goods or services. Value added tax (vat) is a tax levied on sales or supplies of services in portugal. If the turnover exceeds €10,000 it is. 31 rows the relevant nation’s country code — consisting of two letters — is inserted before the vat number if the company is using the. 28. Portugal Vat Number Format.

From www.scribd.com

ESL Country Codes and Customer VAT Number Formats Austria PDF Business Portugal Vat Number Format For a business registered entity on an individual or company format, to carry out business transactions in portugal, it is required to register for vat. Vat is paid by consumers when paying for goods or services. Value added tax (vat) is a tax levied on sales or supplies of services in portugal. Upon completion of the registration process, the taxpayer. Portugal Vat Number Format.

From www.easytax.co

VAT in Portugal the guide to VAT Easytax Portugal Vat Number Format If the turnover exceeds €10,000 it is. The vat laws in portugal are based on eu legislation, of which portugal was a founding member. Vat is paid by consumers when paying for goods or services. Value added tax (vat) is a tax levied on sales or supplies of services in portugal. 28 rows use these eu country codes, vat numbers. Portugal Vat Number Format.

From xneelo.co.za

Update my VAT number xneelo Help Centre Portugal Vat Number Format The vat laws in portugal are based on eu legislation, of which portugal was a founding member. Vat is paid by consumers when paying for goods or services. Value added tax (vat) is a tax levied on sales or supplies of services in portugal. If the turnover exceeds €10,000 it is. Upon completion of the registration process, the taxpayer is. Portugal Vat Number Format.

From www.vatcalc.com

Portugal 2023 VAT registration thresholds Portugal Vat Number Format If the turnover exceeds €10,000 it is. 28 rows use these eu country codes, vat numbers and foreign language letters to complete an ec sales list (esl). Value added tax (vat) is a tax levied on sales or supplies of services in portugal. The vat laws in portugal are based on eu legislation, of which portugal was a founding member.. Portugal Vat Number Format.

From theportugueseeconomy.blogspot.com

The Portuguese Economy VAT gap in Portugal Portugal Vat Number Format The vat laws in portugal are based on eu legislation, of which portugal was a founding member. Upon completion of the registration process, the taxpayer is assigned a tax identification number in the format of. For a business registered entity on an individual or company format, to carry out business transactions in portugal, it is required to register for vat.. Portugal Vat Number Format.

From github.com

GitHub rocketfellows/countryvatnumberformatvalidator Portugal Vat Number Format Upon completion of the registration process, the taxpayer is assigned a tax identification number in the format of. Value added tax (vat) is a tax levied on sales or supplies of services in portugal. If the turnover exceeds €10,000 it is. The vat laws in portugal are based on eu legislation, of which portugal was a founding member. For a. Portugal Vat Number Format.

From immigrantinvest.com

NIF in Portugal How to Get an Individual Tax Number Portugal Vat Number Format If the turnover exceeds €10,000 it is. 28 rows use these eu country codes, vat numbers and foreign language letters to complete an ec sales list (esl). 31 rows the relevant nation’s country code — consisting of two letters — is inserted before the vat number if the company is using the. Vat is paid by consumers when paying for. Portugal Vat Number Format.

From www.globalvatcompliance.com

A comprehensive guide to VAT in Portugal Portugal Vat Number Format Upon completion of the registration process, the taxpayer is assigned a tax identification number in the format of. Value added tax (vat) is a tax levied on sales or supplies of services in portugal. Vat is paid by consumers when paying for goods or services. The vat laws in portugal are based on eu legislation, of which portugal was a. Portugal Vat Number Format.

From www.portugal-accounting.com

What is the Portuguese taxpayer number NIF and what is it used for? Portugal Vat Number Format If the turnover exceeds €10,000 it is. 28 rows use these eu country codes, vat numbers and foreign language letters to complete an ec sales list (esl). The vat laws in portugal are based on eu legislation, of which portugal was a founding member. Upon completion of the registration process, the taxpayer is assigned a tax identification number in the. Portugal Vat Number Format.

From www.fonoa.com

EU VAT Number Formats Portugal Vat Number Format 28 rows use these eu country codes, vat numbers and foreign language letters to complete an ec sales list (esl). The vat laws in portugal are based on eu legislation, of which portugal was a founding member. Vat is paid by consumers when paying for goods or services. Upon completion of the registration process, the taxpayer is assigned a tax. Portugal Vat Number Format.

From sufio.com

Portuguese invoices for Shopify stores Sufio Portugal Vat Number Format 28 rows use these eu country codes, vat numbers and foreign language letters to complete an ec sales list (esl). Value added tax (vat) is a tax levied on sales or supplies of services in portugal. 31 rows the relevant nation’s country code — consisting of two letters — is inserted before the vat number if the company is using. Portugal Vat Number Format.